In today’s digital age, the rise of online banking and transactions has unfortunately been accompanied by a surge in fraud, particularly phishing scams. As members of a credit union in Ireland, it’s crucial to stay informed about these threats and understand how to protect yourself and your finances. This guide aims to equip you with essential knowledge about fraud awareness and effective strategies for phishing protection.

Understanding Phishing

Phishing is a fraudulent attempt to obtain sensitive information such as usernames, passwords, and credit card details by masquerading as a trustworthy entity in electronic communications. Phishers often use deceptive emails, text messages (smishing), or phone calls (vishing) to trick individuals into providing personal information.

Common Types of Phishing

- Email Phishing: Scammers send emails that appear to be from legitimate organisations, asking you to click on links or provide personal information.

- Smishing: This scam involves fraudulent text messages that lure individuals into revealing personal data.

- Vishing: Voice phishing occurs when scammers make phone calls pretending to be from a trusted organisation, requesting sensitive information.

Recognising these tactics is the first step in protecting yourself from fraud.

Signs of a Phishing Attempt

Identifying phishing attempts can be challenging as scammers continually refine their methods. Here are some common signs to look out for:

- Generic Greetings: Emails that start with “Dear Customer” instead of your name can be a red flag.

- Urgency or Threats: Messages that create a sense of urgency (e.g., “Your account will be suspended!”) are often designed to provoke hasty decisions.

- Suspicious Links: Hover over links without clicking them; if the URL looks strange or doesn’t match the organisation’s official website, do not click.

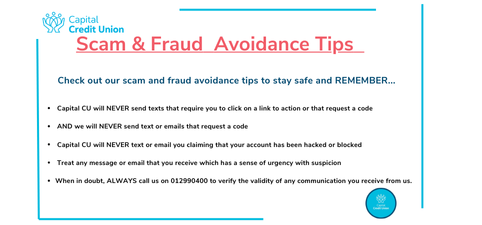

- Requests for Personal Information: Legitimate organisations will never ask for sensitive information via email or text.

By familiarising yourself with these signs, you can better safeguard your personal information.

The Reality of Fraud in Ireland

Recent statistics highlight the urgent need for vigilance against fraud in Ireland:

- In 2023, fraudsters stole nearly €100 million through various scams, marking an increase of over 16% from the previous year.

- Card fraud accounted for 95% of fraudulent transactions and resulted in losses of €35.2 million, while unauthorised electronic transfers represented only 3% of the volume but accounted for a staggering 34% (€33.8 million) of total losses.

- Alarmingly, almost two-thirds of Irish adults have experienced phishing attempts, making Ireland the most phished country globally—nearly twice the global average.

These metrics are a stark reminder that everyone is at risk and emphasise the importance of remaining alert and cautious when managing financial transactions.

Protecting Yourself from Phishing

Here are several strategies to help protect yourself from phishing attacks:

- Use Security Software

Ensure that your computer and mobile devices have up-to-date security software. This software can help detect and block phishing attempts before they reach you.

- Enable Multi-Factor Authentication (MFA)

MFA adds an additional layer of security by requiring two or more verification methods to access your accounts. This could include something you know (a password), something you have (a phone), or something you are (biometric verification).

- Regularly Update Passwords

Use strong, unique passwords for each of your accounts and change them regularly. Consider using a password manager to keep track of your passwords securely.

- Be Cautious with Links and Attachments

Avoid clicking on links or downloading attachments from unknown sources. If you receive an unsolicited message, verify its legitimacy by contacting the organisation directly using known contact information.

- Monitor Your Accounts Regularly

Keep an eye on your bank statements and online accounts for any unauthorised transactions. Early detection is key in mitigating potential losses.

What to Do if You Suspect a Phishing Attack

If you believe you have fallen victim to a phishing scam:

- Do Not Engage Further: Do not respond to the email or message; simply delete it.

- Change Your Passwords Immediately: If you provided any login credentials, change those passwords right away.

- Contact Your Financial Institution: Inform your credit union about the incident so they can monitor for suspicious activity on your account.

- Report the Incident: Report phishing attempts to local authorities or organisations like An Garda Síochána or the National Cyber Security Centre (NCSC) in Ireland.

Staying Informed

Education is one of the most effective tools against fraud. Credit unions can play a vital role by providing resources and hosting workshops on fraud awareness. Participating in initiatives like Cybersecurity Awareness Month can also help keep members informed about the latest threats and protection strategies. The National Cyber Security Centre (NCSC), An Garda Síochána, and the Banking and Payments Federation of Ireland have published guidance to educate the public about how to protect themselves from fraud which are available on the Fraud Smart website (http://www.fraudsmart.ie) and on the NCSC website at www.ncsc.gov.ie/pdfs/NCSC_Quick_Guide_Phishing.pdf.

Conclusion

As members of a credit union in Ireland, being proactive about fraud awareness and phishing protection is essential for safeguarding your financial well-being. By understanding the tactics used by scammers and implementing protective measures, you can significantly reduce your risk of falling victim to fraud. Remember, staying informed and vigilant is your best defence against these ever-evolving threats.

If you need further assistance or have concerns about potential scams, do not hesitate to contact your Capital Credit Union’s dedicated member services team at mailto:info@capitalcu.ie or call 01 2990400. Together, we can combat fraud and ensure your financial safety.

Sources

- FraudSMART Payment Fraud Report 2023

- Banking & Payments Federation Ireland (BPFI) Reports

- RTE News – Phishing Statistics in Ireland