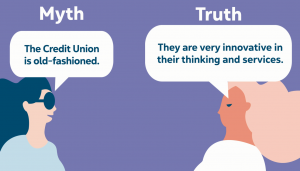

Many people still view the Credit Union as old fashioned when trying to apply for a loan. With banking fees continuously on the rise and adding up in the long term unknowingly. People seem to forget the small things the Credit Union offer that the banks don’t, for example: flexible repayment options, no banking fees and no penalty for early repayment of the loan balance.

On top of that we say yes to over 95% of loan applications, so if you are thinking of borrowing from another financial institution, we say don’t BANK on it.

We will go into more detail later in this article, but first you are probably thinking ‘everybody says how great their loans are, but how do you actually apply for a loan?

Capital Credit Union Loan: What you need to do

To apply for a loan from Capital Credit Union, you must become a member, that means you are not just a customer but an owner of the Credit Union. At Capital, we have several branches around Dublin 2, 4, 6, 8, 12, 14, 16 and 18, so if you live, work or study near these areas, you are eligible to join. Becoming a member only takes a couple of minutes online! You can apply for a loan the same day you become a member.

Loan decisions are based on your ability to repay the loan, not how long you have been a member. We don’t just do small loans, whether it’s a home improvement works e.g. extension, insulation work, renovations etc. you can borrow up to €100,000. We even do mortgages where you can borrow up to €400,000.

You can check out our variety of loan types here or if you know what loan type you want, go straight to our loan calculator here.

What documents do I need for my loan?

This depends on your loan amount and your previous borrowing history with Capital Credit Union.

We recommend submitting an application using our simple Loan Calculator and one of our dedicated Loan Officers will contact you soon after. They’ll go through your application and the documents you need.

Typically for a loan, members may need to provide payslips, bank statements, etc but our Loan Officers will only ask you for what they need so wait for them to contact you before you do too much work!

Will I be dealing with a person or a robot?

We can gladly say you will be speaking directly to our expert loans team and to remind you, we approve over 95% of loan applications.

The loan approval depends on the type/size of the loan you are looking for but we can guarantee our dedicated Loan Officers will give you the best service possible!